Options Trading: Step-by-Step Guide for Beginners

If the stock is higher than $25, the option will be exercised and your shares will be called. And since you own 100 shares, you are completely covered for their delivery, hence the term. If the stock, however, doesn’t fall below the $900 strike, the value of the put can still increase considerably if there’s a sharp bearish move in the underlying’s price with a lot of time left to expiration. https://topbitcoinnews.org/blockchain-and-bitcoin/ Let’s say there’s also $2,500 of extrinsic value remaining in the contract. This would result in a profit of $4,000 (after subtracting your cost to enter the put contract). If you held this to expiration, you would lose all the extrinsic value, and if the stock is still at $880, you would realize a profit of $1,500 if you sold the contract for its intrinsic value of $2,000.

- Of course, the aim is to make a profit, which in this case would happen if the trade is closed when the value of the put is more than the entry price paid to buy the contract.

- To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you receive your bonus.

- Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy.

- We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

Some traders aim to place long puts, or long put spreads, in low IV environments, i.e. underlyings with low IV rank and/or low IV that may be near 52-week highs. The amount of extrinsic value paid for the put or put spread is lower for underlyings with a low IV rank compared to those with high IV rank. The two parties in an options contract have opposite market assumptions – so when one profits, the other incurs a loss. On the other hand, if the underlying price decreases, the trader’s portfolio position loses value, but this loss is largely covered by the gain from the put option position.

Why buy a call option?

Please note – the negative sign before the premium paid represents a cash out flow from my trading account. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. Listed options trade on specialized exchanges such as the Chicago Board Options Exchange (CBOE), the Boston Options Exchange (BOX), or the International Securities Exchange (ISE), among others.

If the stock goes in the opposite price direction (i.e., its price goes down instead of up), then the options expire worthless and the trader loses only $200. Long calls are useful strategies for investors when they are reasonably certain a given stock’s price will increase. If the price of the underlying stays the same or rises, the potential loss will be limited to the option premium, which is paid as insurance. In the example above, at the strike price of $40, the loss is limited to $4.20 per share ($44 – $40 + $0.20).

options trading strategies for beginners

The value of puts and calls depends on the direction you think a stock or the market is heading. Stock options give you the right, but not the obligation, to buy or sell shares at a set dollar amount — the “strike price” — before a specific expiration date. I usually use the Client Portal to send messages (queries/ requests) to ibkr. I briefly used it to purchase some shares and to place an option trade but some options dates are not reflected at the Client Portal. According to the customer service officer that I have checked with, the Client Portal is for more for buying shares and less for trading options.

On the other hand, if the stock doesn’t rise the way you expect, or even if it falls precipitously, you’ll only lose the original $300 premium. But what if you think the stock is set for a sell-off rather than a rally? This gives you the right, but not the obligation, to sell the underlying stock at the strike price on or before the expiration date. Traders and professional investors watch the Greeks to assess potential risks and opportunities in options.

Call options grant you the right to control stock at a fraction of the full price.

Different traders have different trading strategies, needs and skill levels. Anytime nonprofessional investors are part of a major investment trend, Wall Street’s commentariat warns that surging stock prices will soon fall from grace faster than Jerry Falwell Jr. But what really annoys them are the masses horning in on the action.

Di Marzio: Juventus hoping to sign Barcelona midfielder on loan with option to buy – JuveFC

Di Marzio: Juventus hoping to sign Barcelona midfielder on loan with option to buy.

Posted: Sun, 16 Jul 2023 09:01:03 GMT [source]

They can help you figure out those details and weigh the benefits and risks of put options against similar alternatives. But you have to buy the shares before exercising the that uncovered put option. You can buy put options on indexes as well as individual securities. To buy put options, you have to open an account with an options broker. That limits the type of trade you can make based on your experience, financial resources and risk tolerance.

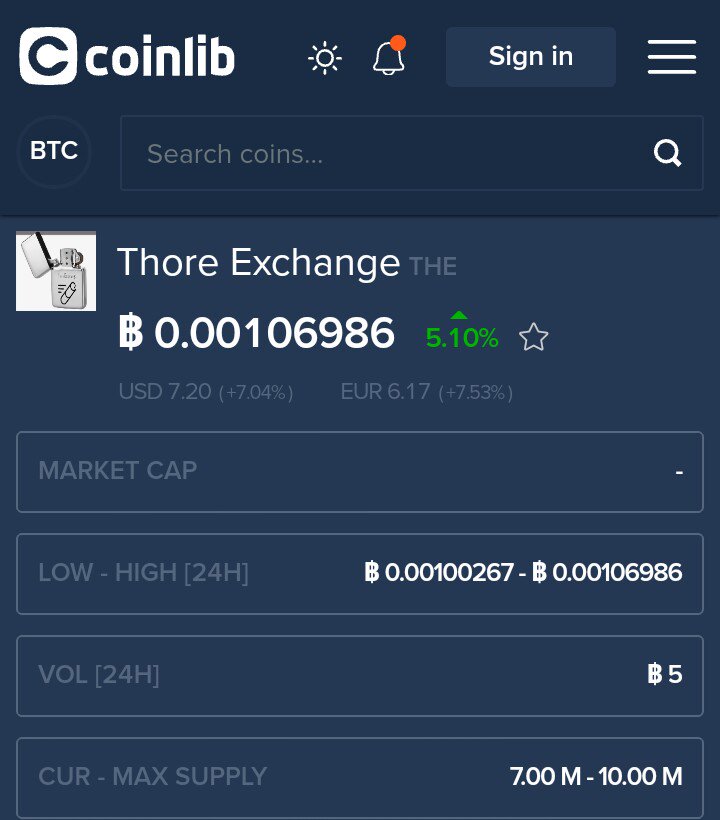

You decide to look at call options that expire three months in the future with a strike price of $150. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Option sellers don’t want volatility, because if stock prices trade in a tight range with little volatility, the options won’t be exercised and would be “out of the money. If you sell a contract, you’re hoping that it expires worthless. In that case, your profitis the amount of the premium you collected for selling the option.

The downside on a long call is a total loss of your investment, $100 in this example. If the stock finishes below the strike price, the call will expire worthless and you’ll be left with nothing. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives.

SHORTING STOCKS

If the stock does not fall below $50, or if indeed it rises, the most you will lose is the $2.00 premium. The broker you choose to trade options with is your most important investing partner. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading.

After paying the $200 option premium, this put option would earn $800. Buying put options is a way to hedge against a potential drop in share price. They could also reap profits from bear markets or declines in the prices of individual stocks. Your losses on buying a call option are limited to the premium you paid for the option plus commissions and any fees. With a futures contract, you have virtually unlimited loss potential. A more aggressive approach is to buy multiple contracts of out-of-the-money options.

If you’re the seller in the long put example, you just want the option to expire OTM and worthless – that means your market assumption is bullish to neutral. So, you need Company XYZ’s stock price ($1,000) to remain above the strike price of $900 at expiration to realize a profit. However, you lose money if the stock doesn’t increase by more than $1 per share in six months. Exercising your option will only make sense if the stock price increases since you would pay more at the strike price than it’s trading for in the market. If you bought ABC stock outright without options, you’d still have the asset and could wait to see if it went up in price later.

On the other hand, if it rises, the value of the put option decreases, which (in this case) is in favor of the short put position. Just like call options, traders can be long or short put contracts, depending on their trading goals. However, if the stock price goes up and your option gets exercised, you are now short the stock.

The option would expire worthless and you’d only forego the $500 premium paid upfront for exposure to the theoretical equivalent of 100 shares of short stock. The put owner can also sell the contract instead of taking short shares to close the position – if the put is worth more than what the trader bought it for up front, the transaction results in a profit. https://cryptominer.services/white-label-payment-gateway-merchant-acquirers-and-iso-sales-partners-medium/ This is when you write (create) a call option for underlying assets you don’t own. In this case, you’d write an option for a stock you think will not increase in price before the expiration date you set. A buyer thinks otherwise and pays you a premium for the contract you wrote. If the option expires worthless, you keep the entire premium as your profit.

The simplest way to make money in the market is to buy a stock or other asset, wait for it to go up in price, and then sell it for a profit. Alternatively, you could buy an option, which doesn’t require you to buy the actual stock. That’s because an option is a contract that lets you decide whether to buy the stock now, buy it later, or not at all.

- There’s an important point to note about the price you pay for options.

- In other words, if the call option has to be profitable it not only has to move above the strike price but it has to move above the breakeven point.

- Now, compare that with the cost of buying the stock, rather than buying the call options.

You must sell 100 shares of ABC so that you don’t have to fulfill the call contract, meaning you are forced to buy shares at the market price, which could theoretically be infinitely high. Since you could pay any price for the shares you now need, your losses could also be infinite. It gives the buyer the right to sell shares at a specific price and the seller the obligation to buy those shares if the option is exercised. Put options are often compared to insurance because they protect your investment against loss from a stock going down in price since you can still sell at the original (presumably higher) strike price.

A standard equity option contract on a stock controls 100 shares of the underlying security. Let’s take a look at some basic strategies that a beginner investor can use with calls or puts to limit https://bitcoin-mining.biz/buy-bitcoin-cash-instantly-in-denmark-buy-bitcoin-cash-with-bank-account-without-verification-2020/ their risk. The first two involve using options to place a direction bet with a limited downside if the bet goes wrong. The others involve hedging strategies laid on top of existing positions.

0 Comments